Arbitrage 101

The explanations and examples in this article are created by our community member puddington#8374.

1. In your own words, explain what arbitrage is and give a real-life example.

Arbitrage opportunities occur when there are small price differences between an asset or related assets in different markets. To profit from this price difference, the arbitrageur can buy the asset or product at a lower price in one market and then sell it for a higher price in another market.

For example, Liam is an egg retailer and buys his eggs in the morning from farmers that sell them for 10 cents an egg out on the countryside, then travels to the city to sell his eggs during the day for 20 cents. Liam can arbitrage the price difference of eggs between the rural and the urban markets, thus earning a profit of 10 cents for each egg he sells.

2. How and why do arbitrage occur in crypto markets, please explain.

Arbitrage opportunities in crypto markets arise when the same crypto asset is traded at different prices on different crypto exchanges. These price discrepancies often stem from differences in liquidity imbalances, volume, variations in transaction speed, and buyer/seller demand between the markets. Arbitrageurs help bring price stability and efficiency to the markets by exploiting these temporary differences and facilitating price convergence.

3. What are the different types of arbitrage that you could perform in crypto markets, please give an example for each.

There are several types of arbitrage strategies that can be performed, here are three interesting ones:

Simple arbitrage: Arbitraging the price imbalance between different liquidity pools or exchanges, the price difference can be exploited by buying and selling the asset simultaneously on different exchanges. James can buy Bitcoin on one exchange for $30,000 and sell on another for $30,030 taking advantage of the price difference for a $30 premium.

Time Arbitrage: Time arbitrage occurs if there is a pricing difference between assets that is logically expected to close over time. By longing the lower priced asset and shorting the higher priced asset a trader is able to make a profit upon closure of the pricing gap. As an example, staked Ethereum used to trade at a lower price compared to Ethereum itself. After the Shapella network upgrade staked Ethereum could be withdrawn to Ethereum causing the price difference to close.

Yield Arbitrage: If one asset trades at a higher yield then a related asset, you may arbitrage the yield difference. In the crypto market, this yield difference is often found using perpetual exchanges. If the funding APR of an Ethereum perpetual amounts to 10%, you would be able to earn 14% on a delta neutral trade, by buying Ethereum, staking at a 4% yield and shorting Ethereum on a perpetual exchange at a 10% yield.

4. Should you arbitrage? Name some of the general risks and benefits.

Arbitraging is one of the most profitable trading strategies, although it involves some risk, it is still considered to be one of the lower risk strategies. As a further benefit, arbitrage can often be structured to be delta neutral, providing no direct market exposure to the assets that are arbitraged. For simple arbitrage, the risk is represented by a small time gap between buying an asset in one market and selling it in another. In this time gap, the movement of the asset price can render your trade unprofitable. It can also involve liquidity risk, which can be mitigated by a proper assessment of the slippage a trade will induce in both markets.

For other types of arbitrage, the risks can be challenging to quantify. If the trade involves leverage, the assets are exposed to liquidation risk. In extreme market situations with low liquidity, liquidation cascades can cause large losses. Furthermore, time and yield arbitrage involve smart contract risk and sometimes third party risk from the protocol owner, if a protocol is not fully decentralized.

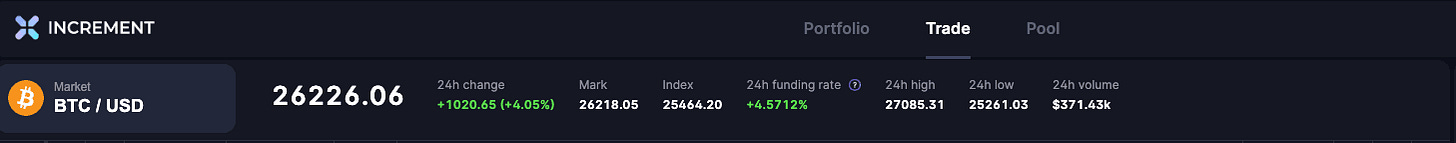

5. On Increment, if you see these prices and funding rates, what would you do? Please describe in detail.

In case of a market situation in the picture above, the BTC/USD perp is trading at a positive 24h funding rate of 4.57%. This would be a unique situation one can profit from by buying Bitcoin on the spot market and shorting the perpetual equivalent earning an APR of 1668% on the USD value of the Bitcoin with no direct market exposure.

6. What is an arbitrage strategy that could only be done onchain and really nowhere else? (Hint: it's a type of loan) Give an example of how you would execute this strategy.

A flash loan is an uncollateralized instant loan borrowed and paid back within the same transaction. These types of loans allow a trader to perform arbitrage trades without any existing assets except for paying the gas fee. It consists of borrowing a large sum of an asset from a money market protocol, executing a profitable arbitrage trade, and returning the loan in one transaction. The trade is ‘cost-free’ apart from the gas fee and involves no risk apart from a loss of the gas fee if the trade can’t be executed profitably.

For example, if Ethereum would be trading at $1807 at liquidity pool A and at $1827 at liquidity pool B, you might perform the following trade using a flash loan:

- Borrowing 100 Eth from Aave.

- Swapping the 100 Eth to 182,700 USD on exchange B.

- Swapping the USD to 101.1 ETH on exchange A.

- Repaying to 100 Eth loan on Aave, earning a 1.1 Eth profit minus the gas fee.

Increment is a decentralized, algorithmic perpetual swaps protocol building on zkSync Era, featuring automatically concentrated liquidity, dynamic fees and parametrizable pools.

To learn more, visit our Docs

For the latest updates and news, follow us on Twitter

Join the community on Discord.