Funding Rate Sensitivity: Balancing Price Convergence and Trader Compensation

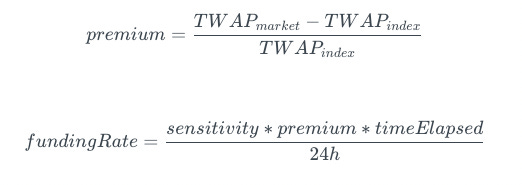

In the Increment developer docs, the term sensitivity is mentioned in this context “With sensitivity, we can control how strongly the funding rate reacts to price deviations.”, along with the following formula:

The funding rate sensitivity parameter has a profound impact on trader’s profit and market stability on Increment. The quest for setting the right sensitivity involves striking a harmonious chord between traders’ profit and loss (PnL) with varying time horizons and optimizing market pricing.

In this article, we delve into funding rate sensitivity, its objectives, trade-offs, purposes, implications for different traders, and the strategic considerations in setting the optimal sensitivity parameter.

Striving for Price Convergence

Funding rates serve dual purposes on Increment:

Incentivizing Price Convergence: Higher funding rates encourage arbitrageurs to converge the perpetual market price with the underlying price. This incentive reduces the deviation magnitude required for arbitrage to be profitable, subsequently narrowing the gap between the perpetual price and underlying price.

Compensating for Market Inefficiencies: Funding rates also compensate traders who find themselves on the wrong side of the premium. This compensates for the opportunity cost of not being able to trade at the true price.

Hence, at its core, the primary goal of setting the funding rate sensitivity is to align traders' PnL as closely as possible to what they would experience if they were trading the underlying market directly. This alignment aims to minimize the impact of fees, funding rates, mispricings, slippage, and price impact, thus ensuring traders can reap the benefits of their trading strategies while minimizing external factors' interference.

Trade-Offs of Funding Rate Sensitivity

Sensitivity of the funding rate carries two critical trade-offs: insufficient sensitivity and excessive sensitivity.

If sensitivity is set too high, traders' PnL become more influenced by funding rate volatility than the underlying market price, potentially leading to an overemphasis on short-term market fluctuations. Conversely, if sensitivity is too low, traders' PnL becomes a function of the current demand for vBase and vQuote tokens on Increment, neglecting the influence of the underlying market price.

Implications for Short-Term and Long-Term Traders

Short-Term Traders: Traders with shorter time horizons are more concerned about accurate pricing due to their frequent trades. Higher sensitivity, which leads to greater compensation for mispricing, is more appealing to these traders.

Long-Term Traders: Traders with longer time horizons are less affected by occasional mispricings since they open and close trades less frequently. They are generally more willing to accept higher "once per trade" costs related to the perpetual pricing inaccuracy.

Therefore, the compensation effect resulting from the sensitivity parameter varies based on traders' time horizons. Traders with shorter time horizons, who are more sensitive to price accuracy, will demand greater compensation for mispricing. As a result, a higher sensitivity, leading to more substantial compensation, tends to attract shorter-term traders more than those with longer horizons.

Strategic Considerations for Setting Sensitivity

Determining the optimal funding rate sensitivity involves several strategies:

Competitive Analysis: Investigate the sensitivities used in other markets, both decentralized (DeFi) and centralized (CeFi), to establish a benchmark for setting initial sensitivity.

Simulation Tests: For smaller markets, carry out tests to understand the effects of decreasing or increasing sensitivity. Monitor changes in open notional, trading volume, and average funding rate to evaluate the net impact on attracting or retaining traders.

Average Trade Duration: Analyze the average trade duration on spot markets (where funding rates do not apply) to gauge traders' preferred time horizons. If the spot market's most popular duration significantly differs from the perpetual market's average, this may guide sensitivity adjustments to attract the desired trader types. Analyzing the average trade duration (ie. time user holds their long or short position) on other perpetual markets is applicable as well.

Elasticity and Cost Reduction: Consider funding rate elasticity – a situation where increasing sensitivity reduces the average deviation and subsequently decreases average funding rates. Strive to find the point where further sensitivity increase stops resulting in lower funding costs.

Conclusion

Taking the above considerations into account, the initial sensitivity number will be proposed to be set as 3 on Increment, which is equivalent to the 8 hour funding payout period that is commonly used in other perpetual markets. Further strategic considerations, experimentation, and thoughtful analysis of traders' behaviour will provide the tools to continue fine-tuning funding rate sensitivity, ensuring a vibrant and balanced trading system.

Authors: disbit, luie

Increment is a decentralized, algorithmic perpetual swaps protocol building on zkSync Era, featuring automatically concentrated liquidity, dynamic fees and parametrizable pools.

To learn more, visit our Docs

For the latest updates and news, follow us on Twitter

Join the community on Discord.